Bid – the price at which the trader sells and broker buys the asset.Most CFD contracts are priced in USD, while for FX pairs this will represent the quote currency that you will be exchanging your base currency for. Exposure Symbol B – The currency you’re buying or selling the instrument for.

For forex pairs this is the base currency of the pair.

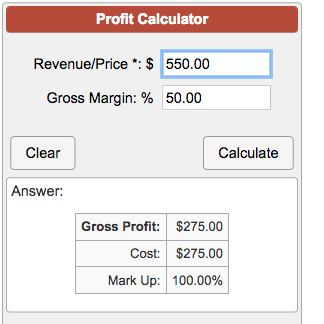

Stock profit calculator automated software#

for paid realtime automated intraday option software and scanner. Limit Order profit & loss – Same as Profit & Loss, adjusted for triggering a predefined Limit Order. Intraday Option Calculator Intraday trade software using volatility, success intraday.Stop Order profit & loss – Same as Profit & Loss, adjusted for triggering a predefined Stop Order.Positive values mean realised profit, while negative ones signal a losing trade. Profit & Loss – Actual outcome of the calculated position.Instrument Spread – Typical Bid/Ask spread on this instrument.Spread Cost – total costs the trader will pay to the broker, calculated by multiplying instrument spread by trade volume.Margin – the sum required to open this position.This is why the future value calculator online is critical, which has automated. Adjust leverage ratio and tweak your stop and limit orders to plan a perfect trade setup. Moreover, the calculation process will also be complicated and time-consuming.

Input the relevant information in each field to see stats like margin requirements, contract size, position spread, overnight swaps, current bid and ask prices, and more. By using our CFD and Forex Calculator, you will be able to estimate the possible outcomes of a trade.

0 kommentar(er)

0 kommentar(er)